Thinking about the year 2020, brings memories of the soundtrack of my most favourite TV series, Diff’rent Strokes.

Now the world don’t move to the beat of just one drum, what might be right for you, may not be right for some. A man is born, he’s a man of means. Then along comes two, they got nothing but their jeans, but they got, diff’rent strokes. It takes diff’rent strokes to move the world. Everybody’s got a special kind of story, everybody finds a way to shine, it don’t matter that you got not a lot. So what, they’ll have theirs, and you’ll have yours, and I’ll have mine. And together we’ll be fine…. Because it takes, diff’rent strokes to move the world, yes, it does. It takes, diff’rent strokes to move the world.

What started as a very promising year for many turned out to be one that unearthed a pandemic that has so far claimed over 1.8 million lives worldwide, after precipitating a global shutdown for a couple of months.

Yet it was not all doom and gloom. It was a year that elicited all manner of responses from markets, businesses and economies around the world, a medley of good and bad. The impacts of the events of the year on the Nigerian economy was the least palatable, and one that may wear off slowly, and painfully so. Yet some good things happened, some of which may well change many fortunes.

THE BAD

A National Slowdown

Since the recession in 2016, the Nigerian economy has struggled to string together any meaning growth in Gross Domestic Product (GDP), the traditional yardstick for measuring the economic health of the nation. After hitting a 4 Year high of 2.55% at the end of 2019, the crash in oil price which followed the global lockdown in 2020 sent the country right back into another recession, with the GDP dropping to -6.1% and -3.62% in Q2 and Q3 respectively.

Inflation, which measures the increase in the price level of goods and services and the rate of loss of purchasing power soared all through the year, rising from 12.13% in January 2020 to 14.89% at the end of November 2020. Unless your investments returned 15.00% or more in 2020, it is likely that you got poorer.

Unemployment

As expected, the 2 months’ lockdown of some states in Nigeria including the Nation’s economic backbones, Lagos and Federal Capital led to a severe disruption of businesses around the Country. According to figures released by the National Bureau of Statistics (NBS), at the end of the lockdown in June 2020, the nation recorded its highest ever documented unemployment rate at 27.10%.

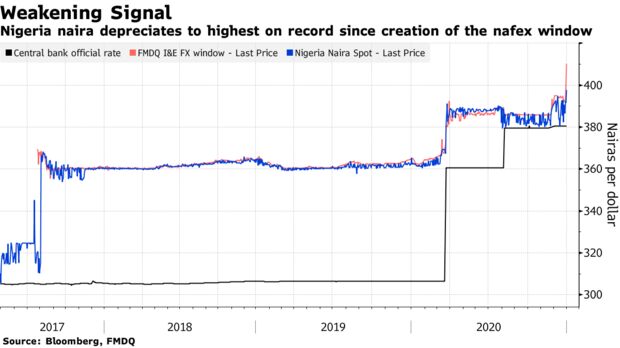

Exchange Rate

Twice in the year 2020, the Central Bank of Nigeria (CBN) adjusted its official exchange rate moving it from N306.5 per $ to 381 per $ as of September 2020. At the parallel (black) market, the Naira depreciated by about 30.00%, moving from N361 per $ at the beginning of the year to N470 per $ at the close of the year.

Treasury bills

The Treasury bill market which had become a safe haven for many investors went from averaging a double digit effective yield at the beginning of the year to less than 1.00% at the end of 2020. 1-year treasury bill at the last auction closed at a paltry 1.210%, which was actually a significant improvement from previous auctions. Fixed deposit rates with Banks and other Financial Institution fared no better ranging between 0.50% to 1.25%.

Honourable Mentions

As expected, economic downturns are often accompanied by a retinue of Ponzi schemes masquerading as genuine investment opportunities. This was no different as we saw the rise of Ponzi schemes disguised as Crowd Funds, Forex trading schemes, Cryptocurrency Funds, etc.

THE GOOD

With all the gloomy toga around the year 2020, it is a bit of a paradox to know that it took some really good turns in many regards.

Life

In a year with so much upheavals, from the shock of the pandemic to the chaos and destructions that characterised the #ENDSARS protest, being alive is truly a gift, a blessing that must be cherished. I have a brother named Isikaku (Meaning life is better than wealth), but for reasons best known to him, he denounced the name. Amidst the vicissitudes of life, we often forget that every new day is a gift from God, an opportunity to become better the world and achieve our dreams.

The Nigerian Stock Market (NSE)

After ending the year 2019 with a loss of -14.36%, the NSE closed 2020 as the best performing index among the 93 stock indexes tracked by Bloomberg, posting a 1-Year return of 50.03%. Investors who took position around April/May 2020 when the market was rock bottom may have even seen better returns than the all share index.

Bitcoin

I can’t even believe that I am writing about a cryptocurrency. I am kind of old school when it comes to investing and some sort of an agnostic when it comes to Decentralised Finance (DeFi). Irrespective, the world’s largest cryptocurrency returned over 300.00% at the end of 2020, with the price surging past $29,000.00. Many non-believers like myself have been converted this year.

Dollar Denominated Assets

Arising from the chronicled devaluation of the Naira and the exacerbating inflation rate, exposure to dollar denominated assets in 2020 proved a “sure winner” for Nigerian investors. Fixed income portfolios with tilt to Eurobonds while averaging around about 8.00%, remained adequately protected against the persistent devaluation of the Naira. On the equity side of things, this year we saw increased Investors’ appetite for US stocks, and understandably so. Investors who managed to obtain exposures to the likes of Tesla (730%), Moderna (430%), Amazon (75%), Netflix (66%), Nvidia Corp (120%), Apple (80%), United Parcel (43%), PayPal (115%) and FedEx (71%) saw very significant returns.

THANKSGIVING

Most of the responses to the events of this year were reactionary rather than proactive. No one had the benefit of knowing which decisions would turn out good or bad. That said, as we look forward to a better 2021, we must be armed with the lessons learnt through the year, an intellectual humility, and a heart of gratitude for an opportunity to apply both. One of the things I am most grateful for this year, is the encouragement I received from my big Sister, Tess Arome-Sule to write this blog. Thank you Sister!

Wishing you all a very prosperous new year.

Together we will all be fine.