Last week, the USA Federal Reserve and the Bank of England delivered a 75 basis point rise in interest rates as they battle inflation. With these moves, the interest rate is up 4% in the USA and 3% in the UK, the highest level seen in the two countries in over fourteen years. Many Central banks around the world are implementing similar interest rate hikes as they battle to combat high inflation. We may debate the effectiveness of these rate hikes and whether we have seen the peak of aggression by these central bank chiefs. It is certain that higher interest rates affect everyone in different ways. To keep it simple: high-interest rates benefit lenders (banks and investors) and hurt borrowers (those who take money from banks and investors).

We look at six ways to navigate or exploit the current high-interest rate environment.

Keep an eye on your loans. If possible, pay them off.

By raising interest rates, central banks expect to make borrowing more expensive, discourage borrowing, limit spending and curtail inflation. If you have a personal loan, credit card, mortgage loan, or salary loan, you must have received a letter from your bank advising you of a higher interest rate. It is not a good time to be a borrower. For instance, In Nigeria interest rate on consumer loans among lending institutions is currently between 25% and 30%.

Considering that rate hikes if it is not properly managed can trigger a recession, you do not want to carry an excessive interest burden at a time of economic uncertainty.

You may consider paying down on high-interest loans, where it is possible to do so. If you are looking to take a new loan, you should carefully consider the necessity of it before signing up for one. If you can defer taking the loan until interest rates come down, it would be a great idea.

Buy longer-term bonds

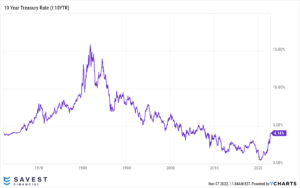

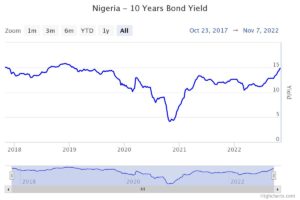

Bond yields have risen globally in response to inflation and rate hikes implemented by the central bank, with most of these rates reaching historical highs.

The yield on the USA 10-year treasury is currently at 4.14%, the highest since October 2007. In Nigeria, the 10-year bond yield currently stands at 14.8%, the highest level since February 2019.

While it is safe to say that yields may still have some room to rise, I do not expect them to rise significantly above the current level. If your investment plan includes the addition of a bond, it may be time to lock in the high yields today for a longer term. Thus, any subsequent decline in rates in the future will benefit you. Unless you are a sophisticated investor, you should aim to match the maturity of the bond against your future obligations to minimize interest rate risk.

Shop for the best savings rates

When interest rates go up, your bank typically informs you immediately if you are a borrower. But if you are a saver, you may not hear of it unless you seek it.

In most instances, you may need to speak with multiple banks and money market fund managers to obtain the best possible rate. Today a couple of financial institutions in Nigeria offer up to 15% on short-term deposits. But you must shop around until you get the best offer.

Stock investment should favour cash-rich companies and pricing power

A high-interest rate is generally bad for stocks. Increased borrowing cost is a burden for most companies and may lead to an economic slowdown and a recession. Investing in stocks at a time like this requires additional diligence.

If your investment plan requires you to own stocks, I recommend that you tilt your portfolio toward cash-rich companies and other companies that can pass the increased cost of business to their customers. Overall ensure that your portfolio is adequately diversified.

Hold dollar assets

Many investors are flocking to hold US dollar-denominated assets given that the US economy is perceived to be in a better shape compared to many advanced economies and the eurozone that is dealing with the Ukrainian crisis, not to mention the emerging markets. With this trend, the US dollar has strengthened against almost every known currency in the world. Although the Naira appears stable against the US dollar if you consider the official rate, based on the parallel market (which is where most transactions occur), the Naira has depreciated by almost 40% against the US dollar.

You should consider adding dollar-denominated assets into your portfolio, especially if you have dollar-denominated obligations.

Hold sufficient near-cash assets in emergency funds

By design, the interest rate hike is meant to inflict hardship on the majority of the people, before things get better. The hardship may include but is not limited to, job losses, depressed asset values, lower corporate profits, and bankruptcy.

You should check and be sure that have enough cash in reserve to cover any emergencies.