It has been five years since my mother passed away, and the emptiness I felt then remains vivid. At the time, it seemed as though my world had crumbled. My lofty ambitions felt insignificant without the woman who had been my greatest source of inspiration. My relationship with my mother was profoundly deep; every quiet moment we shared was among the happiest and purest experiences of my life. She lived a life of exemplary humility, contentment, and generosity—virtues I continue to aspire to but often fall short of achieving. She sacrificed so much for others, and I was the greatest beneficiary of her selflessness. Yet, I never truly had the chance to repay her. When she passed, I felt as though nothing else mattered. That overwhelming wave of grief made my decision to resign from my job in late 2020 much easier.

However, as time unfolded, I learned a sobering truth: father time is undefeated. Six months after her passing, my ambitions resurfaced with vigor, leading me to found Savest Financial to pursue my vocation of helping families manage their wealth. From this experience, I learned a crucial lesson: making long-term decisions based solely on short-term emotions is almost always irrational. Yet, such irrational tendencies are rampant in the investment world, even among professionals who pride themselves on their objectivity.

The Bulls Are Back

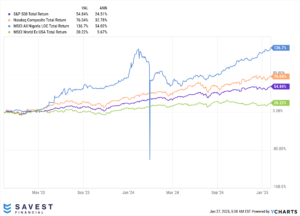

Since August 2023, the gods of investing have smiled on mankind, ushering in unimaginable returns across various asset classes: bonds, stocks, cryptocurrencies, and real estate. The rise of AI, led by Chat GPT in the second half of 2023, signalled the start of a historic bull market run. This period saw the S&P 500 post gains of 26% in 2023 and another 25% in 2024—a back-to-back rally not seen since the 1990s. Back home, Nigeria’s economic landscape also transformed. Tinubu’s presidency and subsequent reforms sparked optimism, driving the Nigerian Exchange (NGX) to post a 46% gain in 2023 and 38% in 2024.

Amid this frenzy, one might expect valuations to spiral out of control. Yet, corporate earnings have grown at a record pace, keeping valuations within reasonable limits. With AI still in its early stages, its promise of making businesses more efficient and the resilience of the global economy bolster the case for the current bull market’s persistence. Initially driven by technology stocks, led by Nvidia—the “Godfather” of AI—the rally has now broadened to other sectors and global markets. It wouldn’t be surprising to hear someone proclaim, “Buy everything in the XYZ sector,” or even for your neighbour to urge you to invest in Elon Musk’s companies as a strategy.

However, it’s crucial to remember that no market condition lasts forever. Despite current trends, markets will eventually revert to the mean. Predicting the timing of the next market shift is nearly impossible, as so much about the market remains unknowable. And, of course, there’s always the potential for a black swan event.

Know Who You Are

Wisdom warns that the worst place to discover your identity is in the market. Investing, particularly in risky assets like stocks and cryptocurrencies, demands prudence and introspection. For example, cryptocurrency enthusiasts now have a champion in the White House, and coins are soaring once again. However, I’m not a crypto expert, and I don’t pretend to be one. This honesty helps me combat any fear of missing out (FOMO). For now, I’m content to observe from the side line.

This is also a time when everyone wants to be a stock picker. If stock picking hasn’t been your game—or a profitable one for you—in the last decade, it’s best to steer clear to avoid financial pain. Stick to the strategies that have worked for you over the years, regardless of how tempting the grass appears on the other side.

Debt Instruments Are Not Risk Free

The resilience of global economies over the past few years has partly been fueled by record levels of government debt accumulation. However, this has not come without consequences. Eurobond investors, for instance, have faced significant losses due to debt renegotiations initiated by Ghana, Zambia, and Ethiopia. Contrary to popular belief, debt instruments—even those issued by governments—are not risk-free and remain susceptible to default. While the high yields in fixed income markets may be tempting, they call for prudent diversification across debt segments, currencies, and maturities.

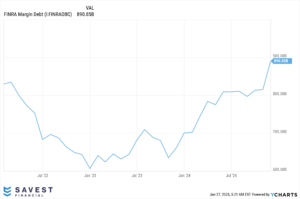

This is Not The Best Time to Invest With Other People’s Money

For those unfamiliar with margin investing, consider yourself fortunate. Margin involves borrowing from your broker to buy stocks, a strategy fraught with risk. Most people take margin loans at the worst possible times—when markets are euphoric—and brokers often demand repayment during downturns, exacerbating losses. Theoretically, the best time to take a margin loan is during a bear market, repaying it as prices rise. However, this is easier said than done. Human behavior often leads investors to borrow during bull markets, only to be forced into selling depressed assets to cover debts, magnifying their losses.

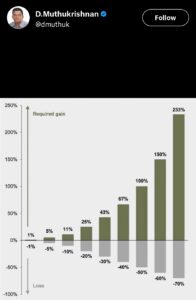

The harsh math of investing underscores the importance of caution. If an asset loses 50% of its value, it requires a 100% return just to break even. This is why it’s crucial to avoid using borrowed money for investing, especially during a bull market. And it’s not just about avoiding brokers’ money; it’s about steering clear of using friends’ and family’s money as well. The risks are best taken with your own capital. History has shown that it rarely ends well otherwise.

Think Long Term

As boring as this sounds, it is probably one of the most profound axioms that will be most impactful on your portfolio in the long run. Investing with a long-term perspective is the cornerstone of building sustainable wealth. While short-term trends and market cycles can be tempting to chase, they are often fleeting and unpredictable. A long-term approach, rooted in discipline and patience, helps investors weather volatility and avoid impulsive decisions. By focusing on fundamentals—such as a company’s future earnings potential, the broader economic outlook, and your personal financial goals—you can make decisions that align with your future aspirations rather than immediate emotions.

Long-term thinking also allows you to harness the power of compounding, which can exponentially grow your wealth over time. Instead of succumbing to the noise of daily market movements, take a step back and consider the bigger picture. Successful investing is less about timing the market and more about time in the market. Diversify wisely, maintain realistic expectations, and remind yourself that financial freedom is a marathon, not a sprint. Remember, the greatest rewards often come to those who resist the allure of instant gratification and remain steadfast in their vision for the future.

In loving memory of my mother – Lady Augustina Lechi Nwokoro